Personal Finance Blogs UK Top 10

This ranking was last updated 13/12/2023.

Vuelio uses a proprietary algorithm to create these rankings, based on topic-related content in blogs on its system – you can read more about the process here. Our research team actively seeks out new blogs and bloggers for inclusion, but if you think we’ve missed someone, please get in touch to let us know.

1. Skint Dad Blog

This year’s ranking of UK personal finance blogs kicks off with a change at the top, with Skint Dad Blog moving up from the second spot for 2023. This blog’s tagline ‘where every penny counts’ is particularly relevant this year as UK citizens battle with stretched budgets while the cost-of-living crisis continues. Luckily, bloggers Ricky and Naomi Willis are here to help with tips and tricks for keeping more money in your pocket – ‘whether you’re looking to cut back on your food bill, save for a rainy day, or find inventive ways to up your income, Skint Dad has the answer’.

2. Monevator

In need of ‘monevation’ for finding the best deals and saving the pennies? The Investor Mark Donald and co-blogger The Accumulator are here to share their canny calculations at Monevator. Check out the categories Earning, Investing, and Property, as well as top tips in the Essential Reading section. Want the basics for making the best use of your budget for investing? Read up on how to create your own cheap, simple, and secure Guaranteed Equity Bond, and the seven habits of highly successful private investors.

3. Debt Camel

Still at number 3 is Debt Camel, where Sara Williams has been helping readers out of debt and scary financial situations since 2013. ‘Independent, impartial, and not-for-profit’, this blog gives solutions on cost-of-living related woes, including issues with smart meters, prepayment meters, what to do if you can’t pay your bills or IVA, and fixes for when your energy DD is wrong. Want direct answers? Check out the ‘A reader asks’ section for longer posts on credit ratings, mortgages, and payday loans refunds.

Up from number 6 is The Humble Penny, the gathering place for a ‘community of fearless dreamers taking action to create financial joy in their lives’. Bloggers Ken and Mary Okoroafor write about topics including side hustles, budgeting, family finances, live hacks, wellbeing, and careers. You can also find details of useful courses, programmes, and workshops, as well as free resources, and books Ken and Mary love. For some positivity as we head towards the festive season, check out ‘5 signs you’ll become wealthy 10 years from now’ and start planning.

Another blog moving up the ranking in this year’s update is for those who feel lost out in the wild when it comes to money matters – The Financial Wilderness. Here to answer the tough questions for those on a strict budget,this blog helps readers navigate daily money management. Is an unlimited cinema pass a good investment, is QuidCo worth it for Cashback, and what are the best UK loyalty cards and apps for this year? Find answers to this to make your way back out of the wilderness and onto safer pathways here.

One of our new entries for this year is Mrs MummyPenny, which sounds like a certain James Bond character, and offers as much action as the film franchise – in terms of keeping ‘healthy wealth, body and mind’, that is. ‘Looking for the latest money saving advice to help you tackle the big squeeze?’ asks blogger Lynn Beattie – this blog has handy links to all of her most popular articles, tips and referral codes, all in one place. For more, check out the ‘Healthy Wealth’ section, which includes posts on life admin alongside the number crunching.

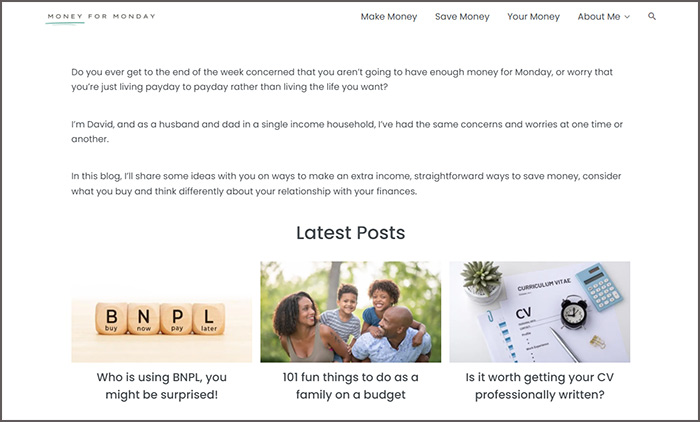

Up from number 10 is Money for Monday, where blogger David offers tips on staying solvent whatever day of the week it is. Aiming to be the ‘go-to destination for unlocking the secrets to wiser financial choices’, David hopes to make his readers’ pockets ‘a little heavier come the end of the week’. Read up on how to Make Money, Save Money, and Family Finance, as well as Money Topics – top tips for now are how to save money by using a Sky dish for Freesat and downsizing to maximise your lifestyle.

Another new blog to welcome into our personal finance ranking is Bee Money Savvy, where the motto is to ‘earn more, spend less, save the bees’. Emma, the ‘one woman team’ that founded this blog, shares the tricks she herself has used to improve her bank balance by ‘spending less and earning more, all while living a more sustainable lifestyle’. If you’re as concerned about saving the environment as you are about saving the £s, find sustainable swaps and easy steps for investing sustainably in your future, and the future of the planet.

Yet another new entry for 2023 comes from Laura, the freelance writer behind Savings 4 Savvy Mums, who started her blog in January 2017 after realising that ‘we’d just survived five years on/off maternity pay and not gone broke’. Sharing the secrets to this, and more, Laura posts daily family money saving tips, budget shopping lists, meal plans, and easy ideas for saving money for your family. ‘I’m here to show you that anything is possible when you have the right help,’ says Laura.

10. Black Girl Finance UK Blog

And we finish on another new blog for this ranking – Black Girl Finance UK Blog, from an ‘award-winning financial coaching company for Black women and women of colour’. Finance coaches Eden Fessahaye, Selina Flavius, and Charlene Simms share their expertise via coaching sessions, a podcast, workshops, a book, events, as well as on this website. Find retirement planning top tips for Black women, stock market tips and strategies, and 10 simple everyday tips for saving money.

Collaborating with bloggers requires mutual respect and understanding: respect their schedules; take time to read their content to learn their interests; and only contact them if/when they want to be contacted. You can see more advice in our blogger spotlights.

Profiles of these blogs and their authors can be found in the Vuelio Media Database.

While we of course hope you find our own blog to be a great and engaging resource, we recognize that there are copious noteworthy blogs out there focusing specifically on the world of finance.

thank you for this article, i have really enjoyed reading this and i will be returning to find out more in the future about private health care

Really like your blog content the way you put up the things…I’ve read the topic with great interest and definitely will stick your blog routinely for other great posts.

Having launched a new site in June 2013 this list will prove useful, although i suspect it will be a challenge to get on their agenda!

Any tips appreciated.

Ashley